vermont income tax rate 2021

The General Tax Rate is used to calculate the tax assessed on a property. Details on how to only prepare and print a Vermont 2021 Tax Return.

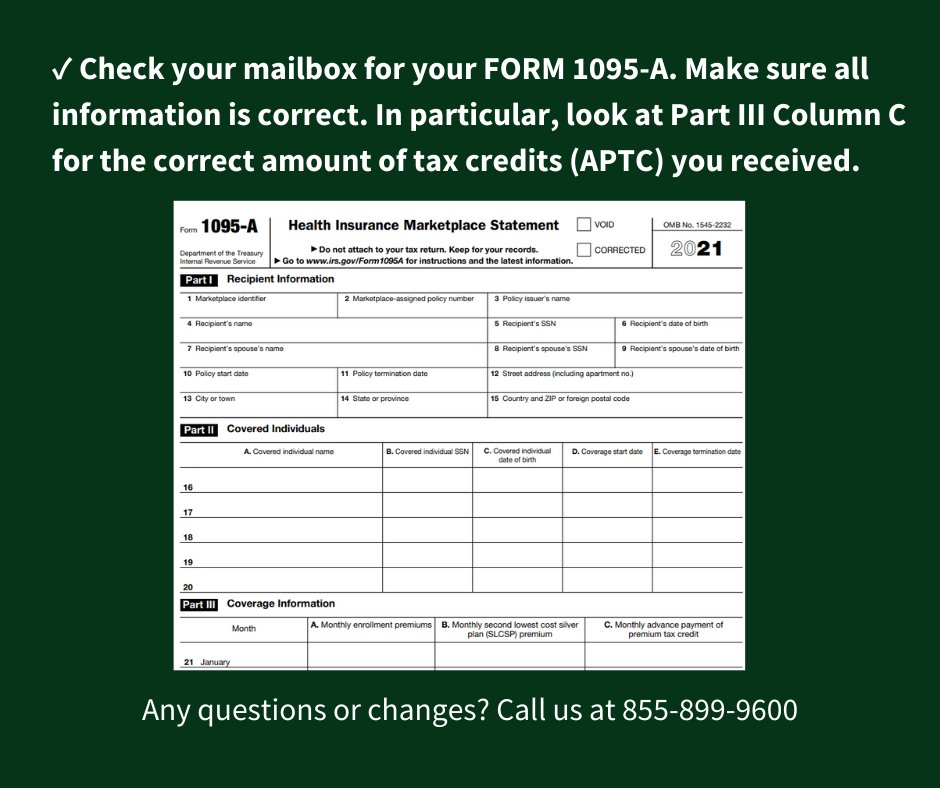

Follow Vt Health Connect S Vthealthconnect Latest Tweets Twitter

Vermonts average education income tax rate would presumably be higher than any of these states average local rates.

. TAX DAY NOW MAY 17th - There are -182 days left until taxes are due. Since a composite return is a combination of various individuals various rates cannot be assessed. Detailed Vermont state income tax rates and brackets are available on this page.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. There are a total of eleven states with higher marginal corporate income tax rates then Vermont. Tax Year 2021 Personal Income Tax - VT Rate Schedules.

Ad Tax Calculator for HOH Single and Married filing Jointly or Separate. IN-111 Vermont Income Tax Return. Vermont Income Tax Rate 2020 - 2021.

Enter 3189 on Form IN-111 Line 8. Allen County levies an income tax at 148 Clinton County at 245 Fountain County at 21 LaGrange County at 165 Marion County at 202 and Sullivan County at 17 as of January 2021. The Vermont tax rate is unchanged from last year however the income tax brackets increased due to the annual.

Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. PA-1 Special Power of Attorney. NEW -- New Jersey Map of Median Rents by Town NEW -- NJ Property Tax Calculator NEW -- Historical New Jersey Property Tax Rates NEW -- New Jersey Realty Transfer Fee Calculator NJ.

Marginal Corporate Income Tax Rate. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try. For Adjusted Gross Incomes IN-111 Line 1 exceeding 150000 Line 8 is the greater of 1 3 of Adjusted Gross Income less interest from US.

RateSched-2021pdf 3251 KB File Format. Vermont Income Tax Calculator 2021. Therefore the composite return Form NJ-1080C uses the highest tax bracket of 1075.

Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on products like gasoline and cigarettes. W-4VT Employees Withholding Allowance Certificate. Discover Helpful Information and Resources on Taxes From AARP.

Vermont Income Tax Forms. Try now for Free. The Vermont tax rate is unchanged from last year however the.

Obligations or 2 Tax Rate ScheduleTax. Vermont State Income Tax Forms for Tax Year 2021 Jan. These back taxes forms can not longer be e-Filed.

Read VT Information on Penalties and Interest. New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets.

Start filing your tax return now. 2021 VT Tax Tables. Vermont also has a 600 percent to 85 percent corporate income tax rate.

Vermont School District Codes. 2021 VT Rate Schedules. If you make 70000 a year living in the region of Vermont USA you will be taxed 12902.

Tuesday January 25 2022 - 1200. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2021. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Use Tax Calculator to know your estimated tax rate in a few steps. You earned or received more than 100 in Vermont income OR. Below are forms for prior Tax Years starting with 2020.

Multiply the result 7000 by 66. Your average tax rate is. Add this amount 462 to Base Tax 2727 for Vermont Tax of 3189.

2022 Income Tax Withholding Instructions Tables and Charts. THE TAX SCHEDULES AND RATES ARE AS FOLLOWS. Vermonts rate schedules are designed to maintain at least 15 years of funding if no additional taxes are paid.

Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Start filing your tax return now. Ad Learn More About the Adjustments to Income Tax Brackets in 2022 vs.

It is equal to 10 per 1000 of the propertys taxable value. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. 7500 25 Of the amount over 50000.

Vermont Income Tax Calculator 2021 If you make 70000 a year living in the region of Vermont USA you will be taxed 10996. All 92 counties in Indiana have an individual income tax ranging from 15 in Vermillion County to 285 in Pulaski County. 2020 VT Rate Schedules.

Tax Rate Class Tax Rate Schedules 1 2.

Learn To Complete And File A Vermont Income Tax Amendment

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Filing Season Updates Department Of Taxes

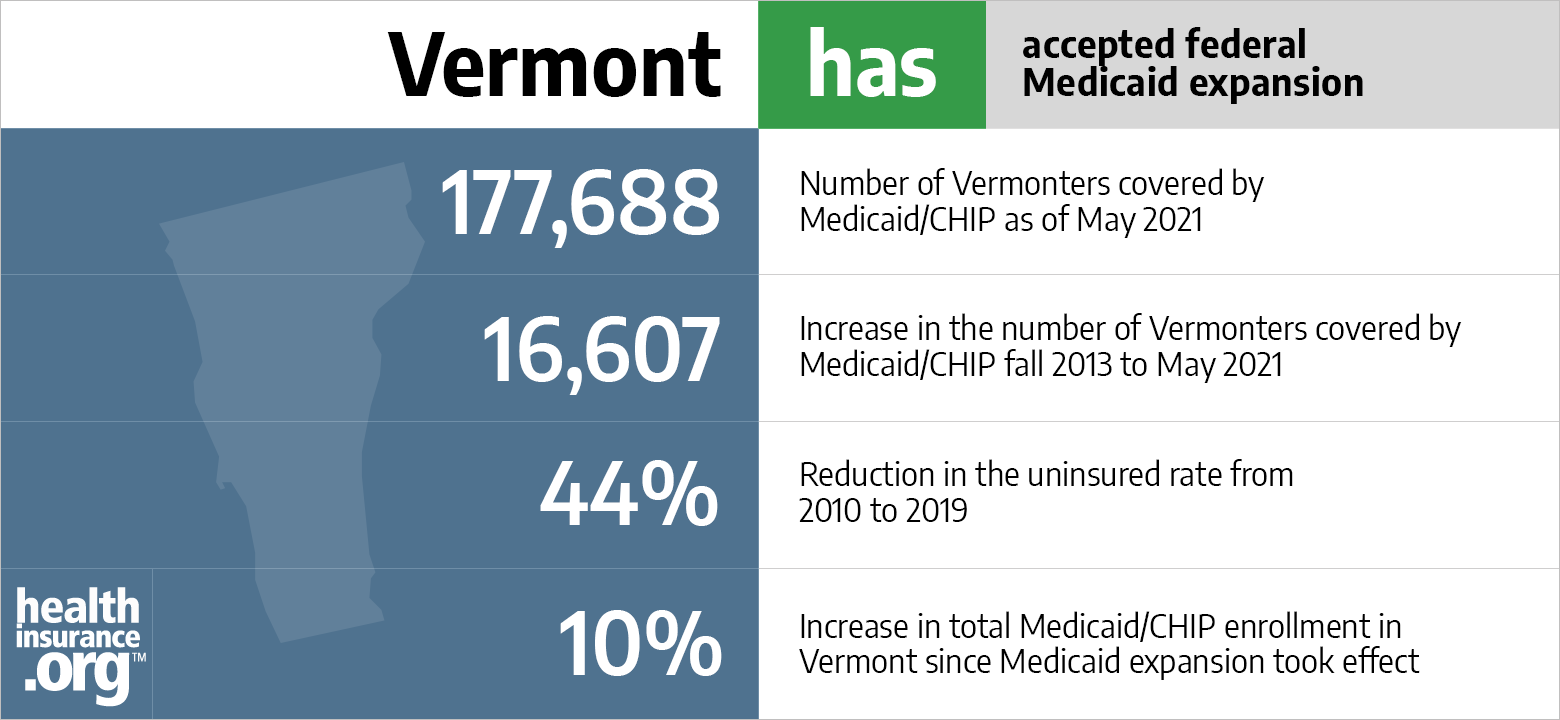

Aca Medicaid Expansion In Vermont Updated 2022 Guide Healthinsurance Org

Filing Season Updates Department Of Taxes

Where S My Refund Vermont H R Block

State Tax Tips For Millionaires Turbotax Tax Tips Videos

Does Your State Have An Individual Alternative Minimum Tax Amt

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Alcohol Excise Tax Rates Tax Policy Center

Filing Season Updates Department Of Taxes

Follow Vt Health Connect S Vthealthconnect Latest Tweets Twitter

Should You Move To A State With No Income Tax Forbes Advisor