capital gains tax news canada

Taxable short-term capital gains and ordinary dividends will be treated exactly as income resulting in the same tax rates and tax brackets being applied. But if you gift the cottage to them or receive the full amount from a sale immediately the capital gains taxes are payable in the tax year of the disposition.

Selling Stock How Capital Gains Are Taxed The Motley Fool

Real estate capital gains tax should be non-starter - Toronto Sun and find out a lot of new information with us.

. Long-term capital gains tax profit from the sale of asset or property held a year or longer rates are 0 15 or 20. Yes there was. Canada News Media provides the latest news from Canada.

Canadas foreign affairs minister to visit Europe for meetings on Ukraine. Digital news subscription tax. Truth Tracker Richard.

The payer chooses to pay a 40 tax rather than a 25 percent tax on dividend payments made by it. Canada has a tax on capital gains of 50. At a time when the country faces momentous economic challenges its hard to think of a more damaging policy than a capital gains tax hike.

May 26 2020 Niels Veldhuis. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. The ontario chapter proposed reducing the capital gains tax exemption to zero meaning all investment.

And the tax rate depends on your income. In 1985 the government introduced a capital gains exemption where each Canadian did not have to pay any tax on capital gains up. You have to include all of your capital gains in your tax return which means that all of your capital gains are included in income.

In Canada the capital gains inclusion rate is 50. Conservative Leader Erin OToole is accusing the Liberals of planning to impose a capital gains tax on people who sell their homes but Justin Trudeau says its not true. On a capital gain of 50000 for instance only half of that amount 25000 is taxable.

For example on a capital gain of 10000 half of that or 5000. How to Calculate Canada Capital Gains Tax in 5 Steps. Real estate capital gains tax should be non-starter.

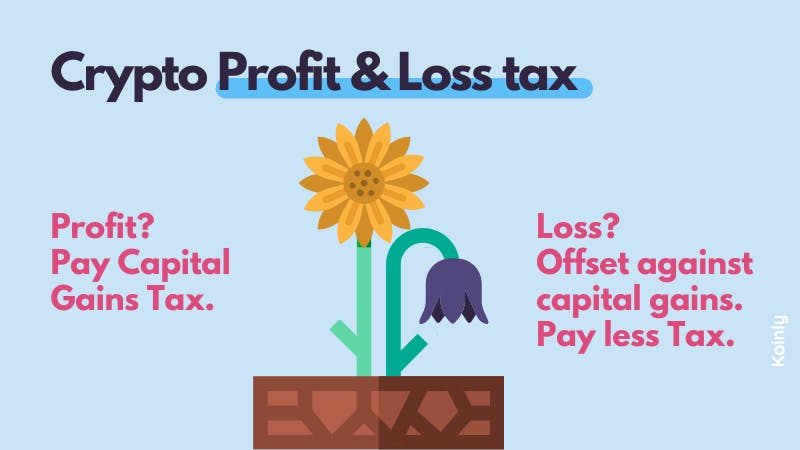

The capital gains tax rate in Ontario for the highest income bracket is 2676. The Senate Bill 5096 took effect in January 2021 and levied a. If you bought bitcoin at 50000 and sold it at 42000 that loss would be treated as a business loss or a capital loss and can be offset against your total business income or capital gains for that year.

Increasing the federal tax would be anti-investment anti-entrepreneurship anti-innovation and anti-green. WATERVILLE The state Attorney General is challenging a Douglas County Superior Court ruling that the 2021 capital gains tax violates the state Constitution. More information on the site.

Photo by Files. The capital gain is not based on the value of the capital property but only on the adjusted cost base. In case you sell the investments at a higher price than you paid for them realized capital gain half of the capital gain will need to be added to your income in order to qualify for tax benefits.

When investors sell a capital property for more than they paid for it the Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. Real estate capital gains tax should be non-starter. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

Real estate sales in Toronto arent going down despite the pandemic. Canadas capital gains inclusion rate is 50. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in.

That would spread the taxable gain over a period of a few years four generally with the taxes due annually in proportion to the payments received. Measure to eliminate the capital gains tax on donations of shares in private. Capital gains tax hike would cripple investment in Canada.

As previously argued here at Finances of the Nation the current system is inequitable because capital gains income is unequally distributed. Short-term capital gain tax or profit from the sale of an asset held for less then a year is taxed at the standard income tax rate. But in Canada today only 50 per cent of realized capital gains are included in taxable income meaning the effective personal tax rate on these gains is only half that of other income.

How Is Dividend Income Taxed In Canada. Capital Gains Exemptions Are Available Through The Federal Government In Canada. A Canadian capital asset includes 50 in Canadas capital gains tax when it is sold for more than its purchase price in excess of its estimated purchase price meaning there are taxes on 50 of the capital gains.

Attorney General Robert Ferguson has asked the state Supreme Court to review Judge Brian Hubers March 1 decision to invalidate the tax. Canada News Media provides the latest news from Canada. In Canada 50 of the value of any capital gains are taxable.

An eligible individual may qualify for a cumulative lifetime capital gains exemption on net gains realized when they sell qualified real estate. You must pay taxes on 50 of this gain at your marginal tax rate. Capital gains tax news canada.

Capital Gains Tax Rate. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province. A report looking for ways to blunt Canadas hot real estate market says Ottawa should accept more immigrant tradespeople raise interest rates and launch a capital gains tax.

If the gain is 50 percent higher than the marginal tax rate then the tax must be paid on the gain.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Capital Gains Losses From Selling Assets Reporting And Taxes

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Capital Gains Definition 2021 Tax Rates And Examples

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

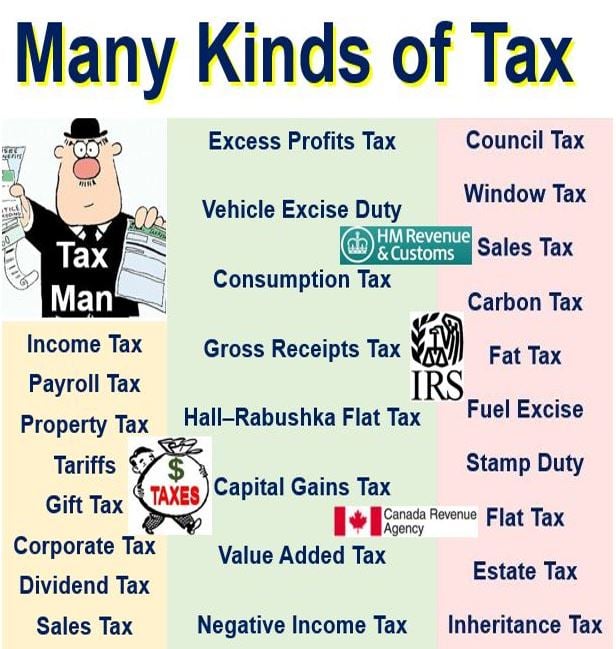

What Is Tax Definition And Meaning Market Business News

Can Capital Gains Push Me Into A Higher Tax Bracket

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

The Ultimate Canada Crypto Tax Guide 2022 Koinly

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Capital Gains Tax Explained What Is It How Much It Is The Turbotax Blog